Nov. 30, 2014 9:03 p.m. ET

Real-estate players long focused on Manhattan’s office market have turned their attention to Long Island City, betting on rising office rents as tenants look for low-cost alternatives in the Queens neighborhood.

announced last week it had agreed to buy the Center Building, a former industrial structure converted into office and retail space. The $142 million price is about 70% more than the sellers paid for it almost two years ago.

This summer, RXR Realty paid about $110 million for the

Building, also in Long Island City. The deal closed for almost three times the property’s price tag six years ago.

Prices for office property in Manhattan are at or near highs with foreign investors looking for places to put their money, said JLL managing director

Michael Shenot.

Manhattan’s traditional large investors are looking to places like Long Island City and Downtown Brooklyn and Dumbo to make the financial returns expected of them, Mr. Shenot said.

“They are getting comfortable that the tenant base is there and they can achieve the goals their shareholders are demanding from them,” Mr. Shenot said.

The Center Building was sold by a joint venture in which a unit of Perella Weinberg Partners teamed up with Madison Marquette to buy it in late 2012. They were pleasantly surprised at how quickly investor interest had shifted toward Long Island City. Vornado declined to provide further details about the purchase and its plans for the property.

“Institutional investors with long-term horizons weren’t looking 10 to 15 years ago,” said

David Schiff,

an executive at Perella Weinberg Partners. “One of the big evolutions here is big name REITs [real-estate investment trusts] and real-estate companies really accepting the boroughs.”

Two to three years ago, rents at these industrial buildings ranged from $12 to $18 a square foot, said

Mitch Arkin,

executive director at Cushman Wakefield Inc., which handles leasing for the Falchi Building in Long Island City. Many tenants used the space for light assembly or manufacturing.

Today, there are more office tenants, from e-commerce firms to New York City agencies. Some of these buildings now command rents between $30 and $35 a square foot, Mr. Arkin said.

Those prices still fall short of Manhattan office rents, which averaged $64.91 in the third quarter and rose 6.2% from the previous year, according to JLL.

“One of the major drivers is that it is a low-cost alternative to Midtown Manhattan,” said

Arvind Bajaj,

who was a managing director at Madison Marquette when it purchased the Center Building in 2012. He and two former colleagues recently left Madison Marquette to set up a new real-estate investment firm called SRB Ventures with the Andalex Group.

The Falchi Building, which Jamestown LP bought in 2012, has served as a model of sorts. It has a ground-floor space dedicated to food vendors, creating an amenity for other tenants and the neighborhood. The former owners of the Center Building transformed the loading docks into shop space, some of which has been leased to food vendors.

Other landlords also have looked to create special features. The Standard Motor Products Building has an urban rooftop farm that offers its produce for sale to tenants. The service has proved popular, said

William Elder,

executive vice president at RXR Realty.

“New York City is getting to a point where certain tenants want to be in non-shiny skyscraper buildings and can’t afford the rent [in Midtown and Midtown South], so they are moving downtown [in Manhattan] and to the outer boroughs,” Mr. Elder said. RXR can tap into this migration with properties such as the Standard Motor Products Building offering rents lower than those in prime Manhattan markets.

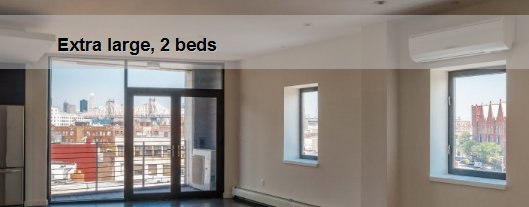

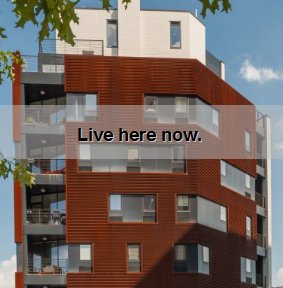

Long Island City’s proximity to Midtown and subway access has helped raise the neighborhood’s profile. Still, past efforts to boost office development have been eclipsed by the area’s residential boom over the past decade, real-estate executives said. More apartment buildings are expected to fill in the area’s less-developed stretches.

One example of the area’s rapidly rising property values is the recent sale of 29-27 Queens Plaza North. The 1920s building, which has been the focus of a landmarking campaign, is known to locals as the Clock Tower. It sold for $30.9 million, more than twice the price sellers paid for it six months ago.

Kamran Hakim,

owner of the Hakim Organization that led the joint venture buying the building, said no decisions had been made and it was exploring different development ideas including residential use.

Residential growth in Long Island City and places like neighboring Astoria could help the office market. The trend is for people to live closer to where they work, Mr. Elder said.

“You’ve got some great neighborhoods between Astoria and the [Long Island City] waterfront,” Mr. Elder said. “You’ve got a great base of labor that is very close by.”